Our Products

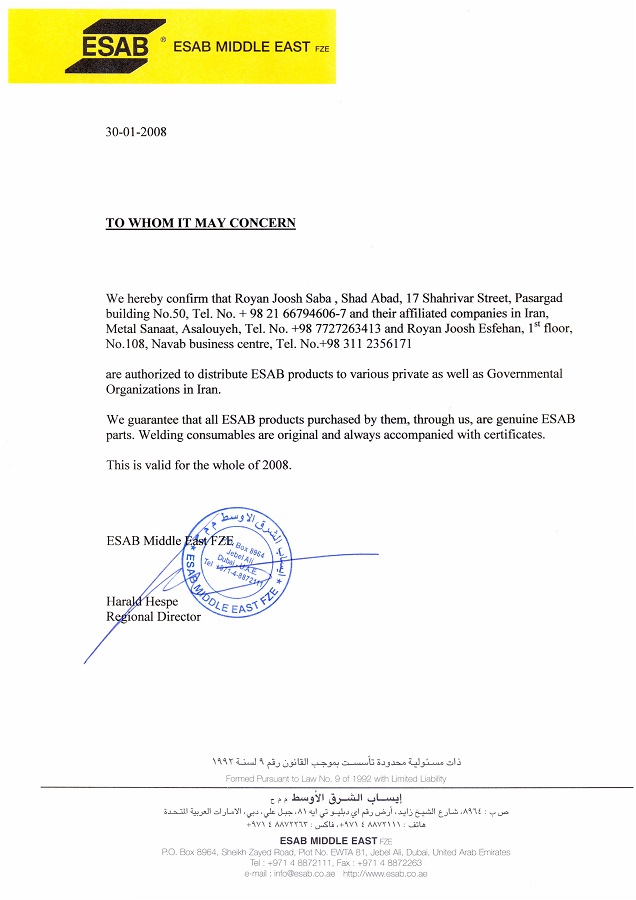

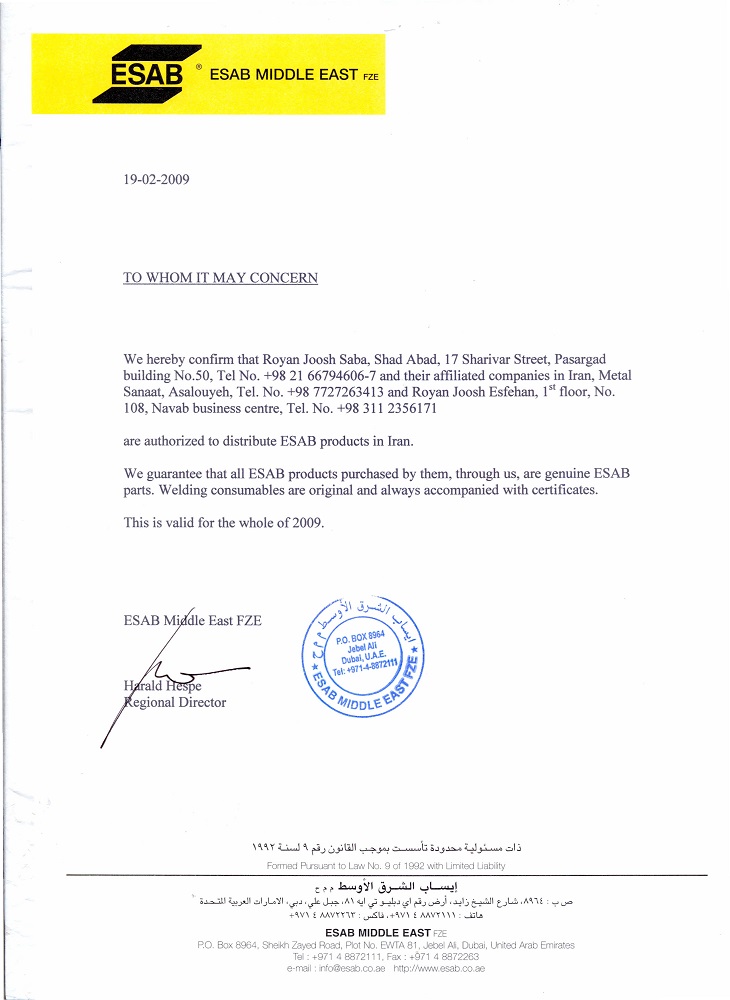

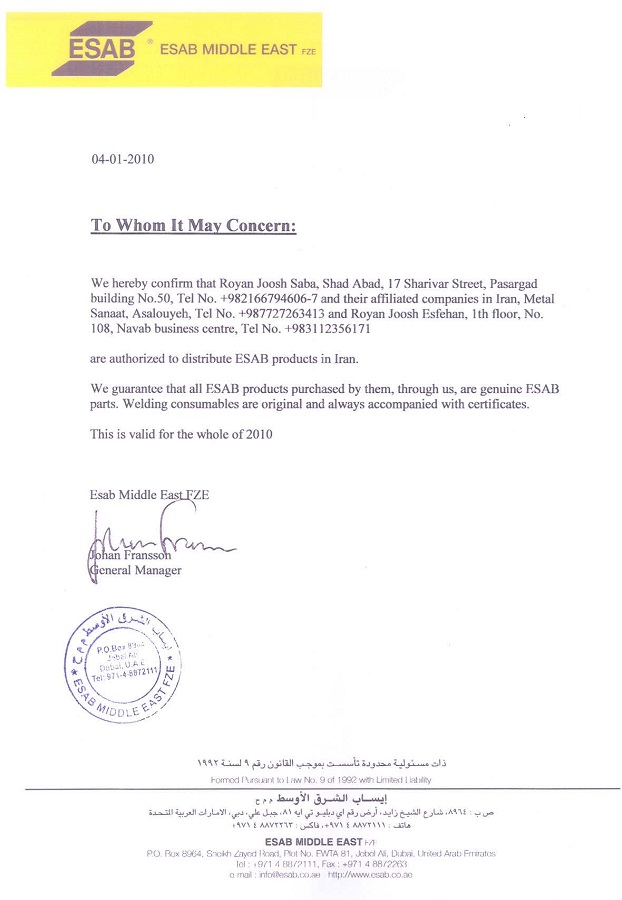

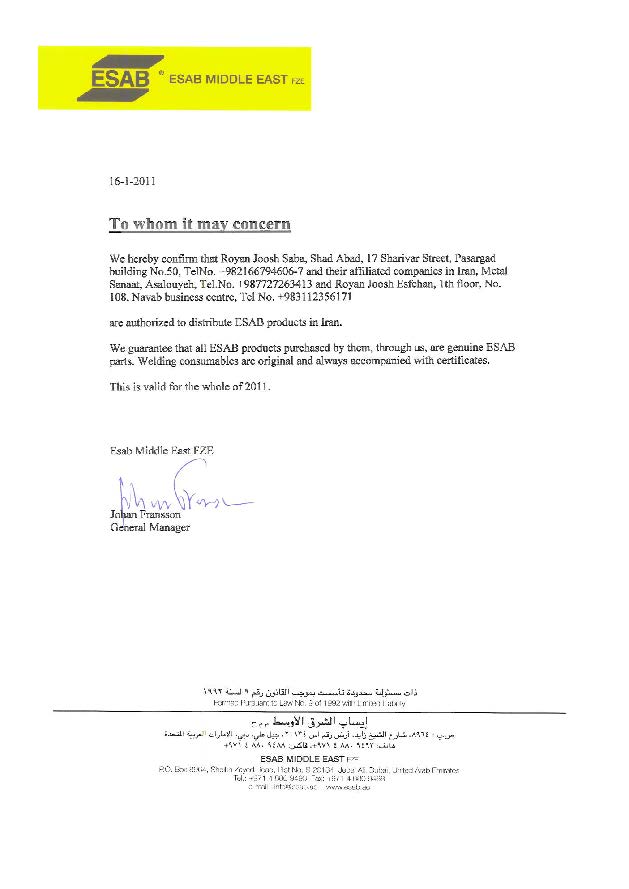

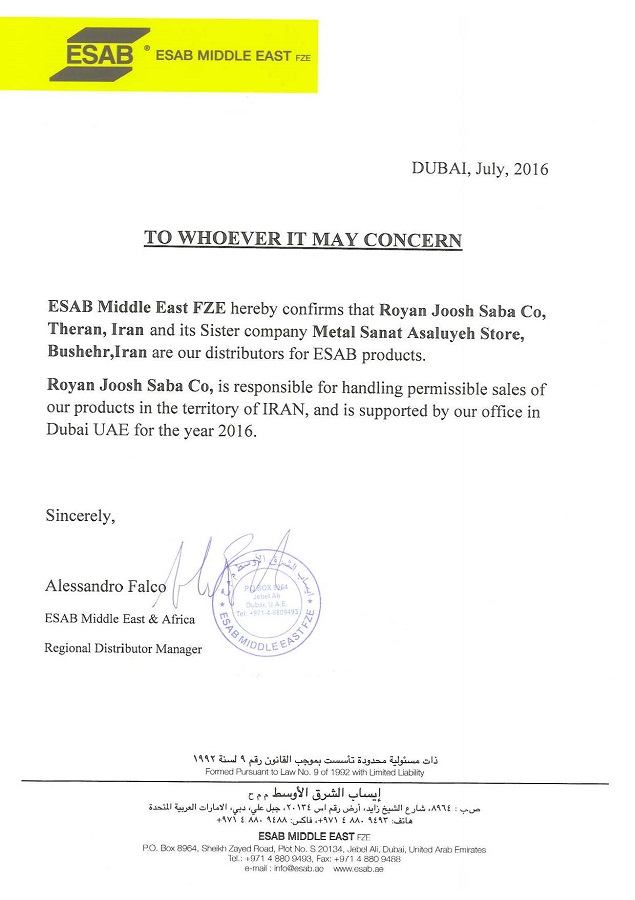

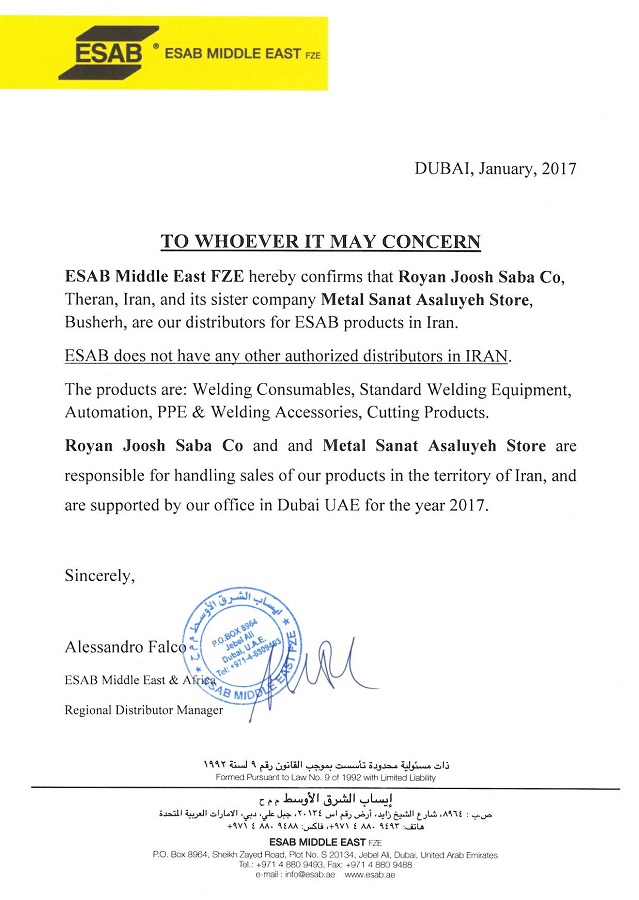

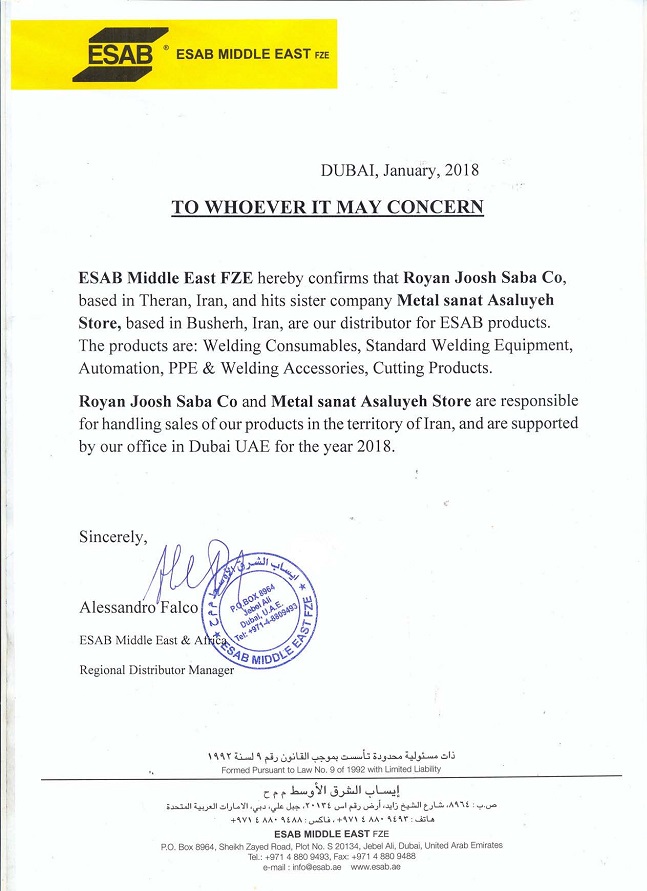

Royan Joosh

Equivalence of ESAB Electrodes With Other Brands

MoreESAB Welding Skills Training

MoreSelection of Electrode, Filler and ESAB Fluxes

MoreHow To Purchase The Products of ESAB

MoreConsultation request

ESAB HandBook

Royan Joosh

Gallery

Royan Joosh